No agency has a richer history in long-term care than North American Insurance Services. Through our strategic partners, we provide insurance agents and financial advisors with the most comprehensive portfolio of solutions and the most in-depth training.

The Problem: The catastrophic financial, emotional, and mental costs of LTC

Long-term care…what is it and who needs it?

Long-term care refers to services that support individuals with chronic illnesses or disabilities who are unable to care for themselves over an extended period, addressing both their medical and non-medical needs.

About 70% of people who reach age 65 are estimated to need long-term care at some point in their lives, and approximately 20% will require care for more than five years. Long-term care may be needed due to factors such as chronic illness, disability, injury, cognitive impairment, or aging. As the population ages, the demand for long-term care is expected to rise, making it a crucial issue for individuals and agents to address.

Approximately 10,000 people in the U.S. turn 65 every day, a trend expected to continue as the baby boomer generation retires. This demographic shift will impact healthcare, social security, and the economy. It underscores the need for planning for long-term care, as the likelihood of needing it increases with age.

The financial cost of long term care

Long-term care can be costly and the top concern for many in retirement is running out of money. Expenses for long-term care, such as caregiving services, medical expenses, home modifications, transportation, lost income for caregivers, and opportunity costs, can add up quickly. Careful planning, including purchasing long-term care insurance, saving for potential care costs, and working with a financial advisor, is crucial to ensure adequate resources.

According to the Genworth Cost of Care Survey 2020, the national median cost for a private room in a nursing home was $105,850 per year, and the median cost for a home health aide was $54,912 per year.

Approximately 42 million Americans have provided unpaid care to an adult age 50 or older in the prior 12 months. Caring for someone who needs long-term care can have significant mental and emotional challenges for caregivers. It can lead to stress, burnout, depression, isolation, guilt, resentment, financial strain, and a loss of identity. Caregivers may feel overwhelmed, exhausted, and disconnected from their social networks. It’s important for caregivers to prioritize their own mental and emotional well-being by seeking support, taking time for self-care, and engaging in activities that bring them joy.

In Summary

By not having a long-term care plan, your family becomes your long-term care plan. Long-term care provides ongoing help for people who need assistance with daily tasks because of their age, illness, or disability. It includes medical, social, and personal care and can be given in different places like nursing homes, assisted living facilities, or at home. It helps people keep their independence, quality of life, and dignity, while also supporting their family and caregivers. With more people living longer and having chronic health issues, long-term care is becoming increasingly important for the healthcare system.

Additional Resources

- Genworth Cost of Care Survey

- National Institute on Aging

- Administration for Community Living

- U.S. Department of Health & Human Services

- What Care Costs (use sponsor code LTC)

- The Agony of Putting Your Life on Hold to Care for Your Parents

- Concourse Financial Group LTC Handbook

- Nashville Public Television: Reimagining LTC

The Solution: We now have many LTC solutions to address the issue

Long-term care insurance covers costs for services like nursing home care, home health care, and assisted living facilities, which are usually not covered by regular health insurance. It’s important to note that 70% of long-term care claimants receive care at home, while 13% are in assisted living and 13% are in nursing homes.

Long-term care insurance has several benefits, including protecting assets by covering expensive long-term care services, avoiding reliance on family members for care, maintaining independence, and preparing for the future. It can provide peace of mind and help individuals plan ahead. It’s crucial to carefully assess the costs and benefits of long-term care insurance and consult with a financial advisor before deciding.

Types of Long Term Care Insurance Products

There are several different types of long-term care insurance solutions available, each with its own features and benefits. Some of the most common types of long-term care insurance include:

- Traditional long-term care insurance. This type of insurance provides coverage for long-term care services, such as assistance with daily living activities, nursing home care, and home healthcare. Benefits are paid out either as a daily or monthly benefit amount for a specified period, usually up to 5years. Carriers: Mutual of Omaha

- Life insurance with a long-term care rider. This type of insurance allows policyholders to access the death benefit of their life insurance policy if they need long-term care. If the policyholder does not use the long-term care benefits, the death benefit will be paid out to their beneficiaries. Carriers: OneAmerica, Nationwide

- Annuities with long-term care benefits. This type of insurance allows policyholders to receive a guaranteed income stream in exchange for a lump sum payment. Some annuities also include long-term care benefits, which can help cover the cost of long-term care services. Carriers: OneAmerica, Nationwide

- Short-term care insurance. This type of insurance provides coverage for a shorter period, typically up to one year, and is designed to cover temporary needs for care. Short-term care insurance can provide benefits for services such as rehabilitation, home healthcare, and assisted living. Carriers: Manhattan, Aetna

- Prepaid home healthcare. This is a non-insurance product where individuals or their families pay in advance for a specified amount of home healthcare services. These services are typically provided by licensed healthcare professionals in the individual’s home and may include assistance with activities of daily living, medication management, wound care, and other medical or non-medical services. Carrier: True Freedom

In Summary

Long-term care insurance is essential to protect against the significant financial costs and potential emotional toll of needing long-term care. With the high costs of caregiving services, medical expenses, home modifications, transportation, lost income for caregivers, and the mental and emotional challenges faced by caregivers, having good long-term care insurance can provide the necessary financial resources and peace of mind to ensure that one’s long-term care needs are met without depleting personal savings or burdening loved ones.

When considering long-term care insurance solutions, it’s important to evaluate each option carefully and consider factors such as cost, coverage, and the level of flexibility and customization available.

Additional Resources

- A Shopper’s Guide to Long-Term Care Insurance

- Concourse Financial Group: Preparing for Long-Term Care & Chronic Illness Expenses

- 10 Reasons Why Long-Term Care Insurance Is Essential To Your Financial Plan

- Long-Term Care Insurance 101

- Long-Term Care Insurance Explained

- Step-by-Step: A guide to receiving long-term care

- What you need to know about long-term care insurance

Marketing: How to cross sell LTC to existing health and Medicare clients

Cross Selling

Medicare primarily covers hospital stays, doctor visits, and prescription drugs for individuals who are 65 years or older. However, Medicare does not cover most long-term care services, such as assistance with activities of daily living (ADLs) like bathing, dressing, and eating.

Medicare only covers a limited amount of skilled nursing facility care following a hospital stay, and only if certain conditions are met. It will not cover expenses such as home health aides, assisted living facilities, and nursing homes.

Traditional health insurance for your under 65 clients will not cover these expenses either. Your clients may have to pay for these services out of pocket unless they have some kind of Long-term care insurance.

There are 4 ways to fund long term care needs:

- Medicare – This only covers 100 days of skilled and rehabilitative care.

- Medicaid – Like Medicare it is limited to skilled and rehabilitative care, but it is for people who have lower income. It can also be expensive to spend down to qualify.

- Self-Pay – Just like it sounds, some people’s plan is to use their assets and savings to pay for long term care. The average cost of a private room in a nursing home is over $100,000 a year.

- Long-Term Care Insurance – We have many options.

Start by asking your client about their plan for long-term care. Show them the gap in their plan and ask if you can show some options. The average age is 56 for the average long term care insurance buyer, and age 80 is the average age for a claimant. Someone turning 65 is a great client for LTC if they do not already have it, but the earlier the better. Single females age 60’s and 70’s are great clients as well.

The Agent Opportunity: How to double your income from every health or Medicare sale by cross selling LTC

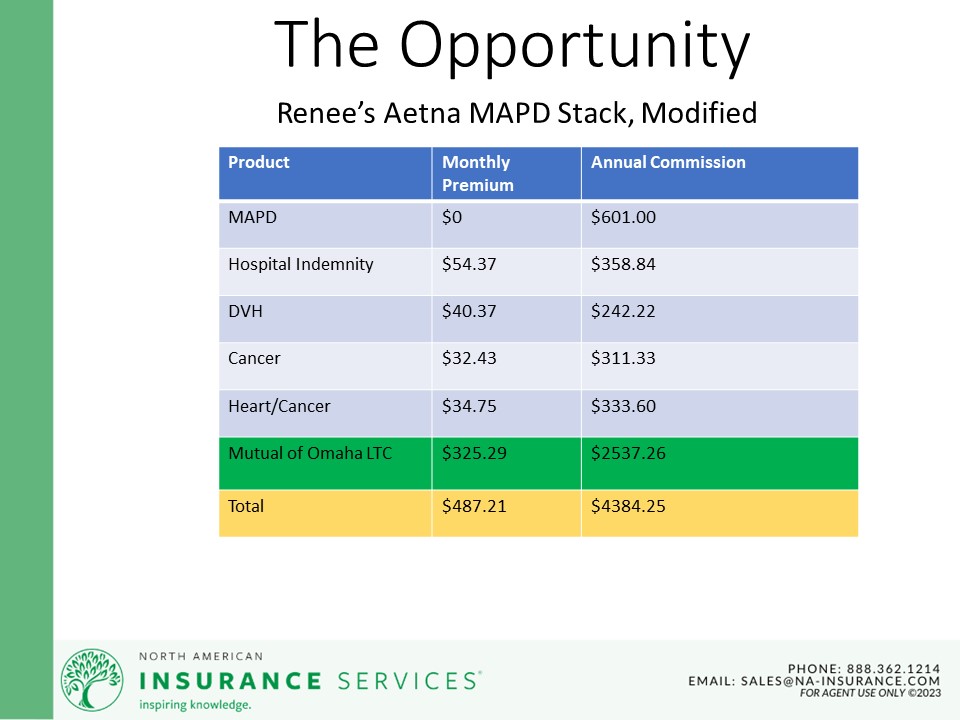

You are already stacking products with your Medicare sales. Adding long term care to the conversation will not only help your clients with their needs but will add to your income.

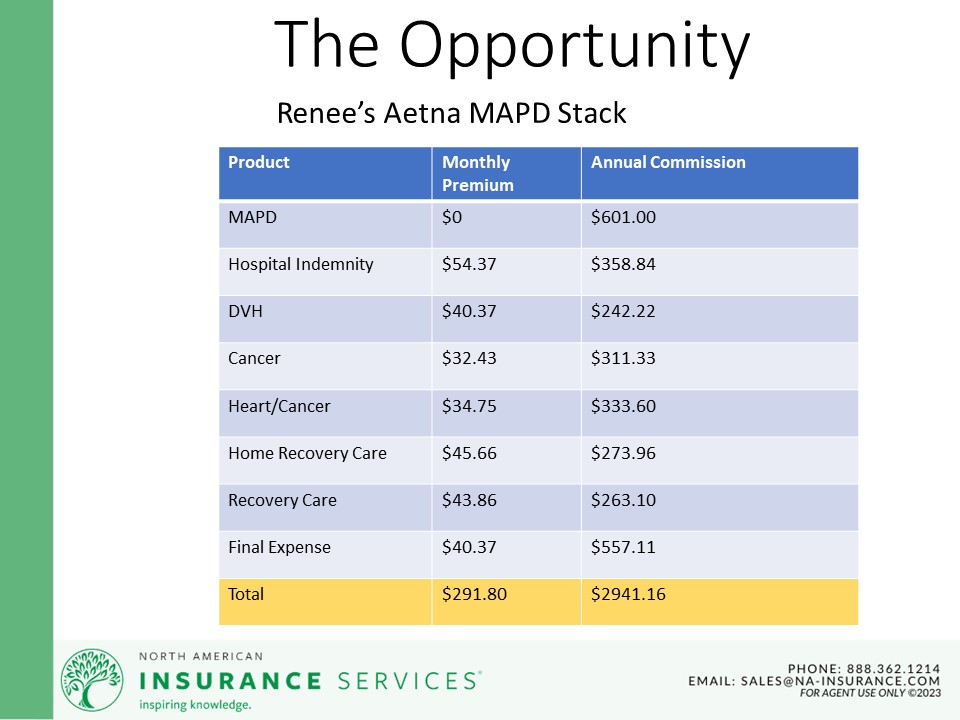

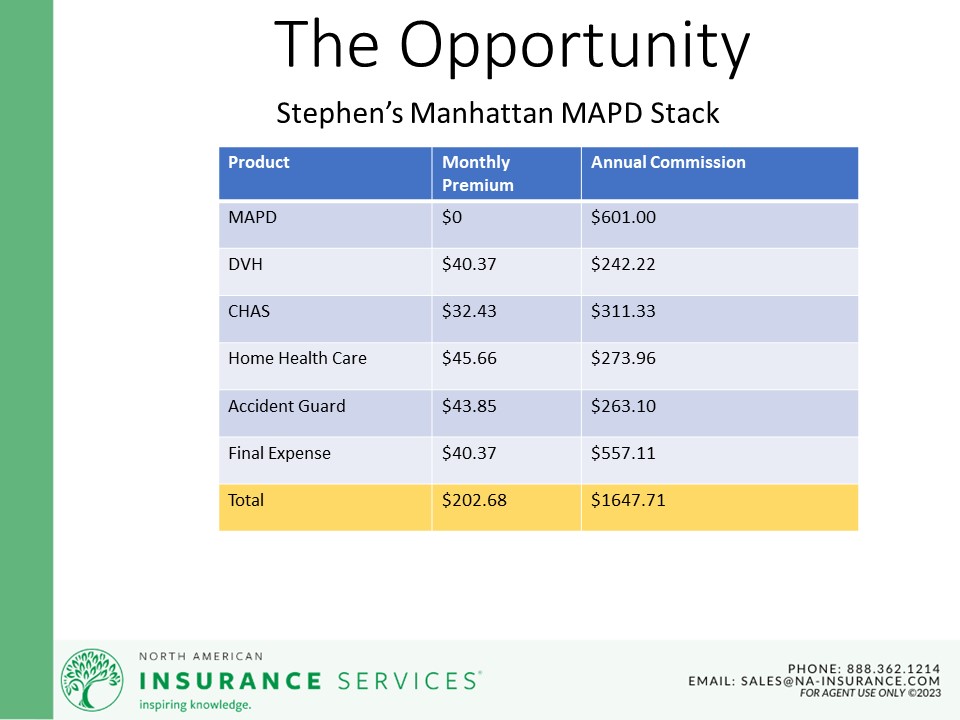

Here are some great examples of Medicare Advantage stacks with long term care and short term care options:

Additional Resources

Next Steps: How to get trained and certified in long-term care

So what’s next? If you want to get started and be a part of our long-term care track at NAIS:

- Join our new LTC program at NAIS led by Eric Jans.

- Contact sales@na-insurance.com and tell us you want to get contracted through Concourse Financial.

- Make sure to follow your state’s CE requirements to offer long-term care products.

- Consider getting your CLTC designation, contact Max Brewer.

- Talk to your current clients about their plans for long-term care.

- Find a OneAmerica road show near you.

- Read a great book about long-term care: “The Conversation” by Harley Gordon